The Silent Killer: What is Involuntary Churn and How Much Revenue is it Costing You?

Published on May 28, 2025

• By Burak Isik

Ever had that sinking feeling when you check your MRR and it's down, but your cancellation emails don't tell the whole story? Chances are, you've been hit by the phantom menace of SaaS: involuntary churn. It's the customer you didn't know you lost, the subscription that quietly slipped away, draining profits while you're busy tackling those who actively hit 'cancel.'

So, what is this sneaky revenue thief, and how much is it really costing you? Let's investigate.

The Real Scoop on Vanishing Customers

Involuntary churn. Sounds bland, right? Wrong. It's when customers, who actually want to keep paying you, get booted because their payment fails. Think expired cards (the usual suspect!), sudden bank declines, or billing addresses from last year. It's a ninja problem because these folks intended to stay.

Why It Bites Hard: It's not just about the lost MRR (though that hurts plenty). You're also shredding your Customer Acquisition Cost (CAC), watching that precious Lifetime Value (LTV) evaporate, and bogging down your team with payment fire drills.

The First Step to Fighting Back: You can't fix what you can't see. It starts with a no-BS look at your payment data to find out how many customers are really disappearing due to these glitches. Spoiler: It's probably more than you think (and more than your current dashboards are telling you).

So, What IS This Involuntary Churn Beast Anyway?

Alright, let's break it down. Involuntary churn (some call it passive churn, others delinquent churn – fancy names for the same headache) is what happens when a customer's subscription gets axed because their payment went sideways. The key here is they didn't choose to leave.

It's the polar opposite of voluntary churn, where a customer makes a conscious call to break up with your service – maybe they found a shinier toy, their needs changed, or (ouch) they weren't thrilled with what you offer.

Who are the usual suspects causing these involuntary goodbyes?

- Expired Credit Cards: Yep, the classic. They expire. People forget. Revenue drops.

- Hard Declines: The bank basically says, "Not today." Could be insufficient funds, a card reported lost or stolen, or a fraud flag (sometimes a false alarm!).

- Soft Declines: More like a temporary hiccup – a card limit briefly hit, a momentary processor brain fart. These might just work if you try again, but who's coordinating that?

- Outdated Billing Info: It's not just the card. An old address, a typo in the ZIP code – little things that cause big payment headaches.

- Payment Processor Gremlins: Sometimes, the fault isn't with your customer or their card. The wonderful world of payment processing has its own mysterious ways.

Why It's a "Silent Killer" (And Not Just Mildly Annoying)

This isn't just a minor bookkeeping issue; involuntary churn has truly earned its ominous title:

- Ghosting (Customer-Style): Often, your customer is blissfully unaware their payment flopped until they suddenly can't log in. They weren't planning a dramatic exit.

- Passive, Not Aggressive: No angry cancellation feedback, no support tickets (initially). The subscription just fades out, making it harder to spot immediately.

- The Master of Disguise: If you're not meticulously tracking payment decline codes (and who has time for that across multiple processors?), it's easy to lump these payment failures in with voluntary churn. This masks the true, often alarming, scale of perfectly preventable customer loss.

Think about it from Revenue Rachel's perspective: these were good customers! They liked your service enough to keep their subscription active. Losing them isn't just a shame; it's a missed opportunity that, in many cases, a bit of payment data savvy could have saved.

The Real Cost: It's Way More Than Just Lost MRR

If you only focus on the immediate lost Monthly Recurring Revenue (MRR), you're just seeing the tip of the iceberg. The financial damage from involuntary churn ripples out in ways that can seriously impact your growth.

-

Direct Revenue Loss (The Obvious Sting): This one's easy to grasp. Lose 97 customers this month to payment fails, and your ARPU is, say, $53.78? That's an instant $5,216.66 gap in your MRR. Annually? Over $62,500 just…gone.

Quick Back-of-the-Napkin Math: (Number of Involuntarily Churned Customers) x (Average MRR per Customer) = Lost MRR. For instance: 43 customers x $105/month = $4,515 lost MRR.

-

Torched Customer Acquisition Cost (CAC): Remember all that cash you burned on marketing and sales to get that customer? Poof. Gone. If your CAC is $312, and you lose those 43 customers, that's $13,416 in acquisition efforts vaporized.

-

Clipped Customer Lifetime Value (LTV): Every involuntary churn cuts a customer relationship short. You don't just lose this month's payment; you lose all the potential future revenue they would have brought in. That LTV:CAC ratio takes a nosedive.

-

Operational Drag: Your finance, support, or RevOps teams are now playing detective, chasing failed payments, trying to contact customers with outdated info, and manually wrestling with billing systems. That's precious time not spent on growth or proactive customer success.

-

Brand Bruises & CX Nightmares: Let's be honest, a clunky payment failure experience is frustrating. If a customer suddenly loses access to a vital service because of a payment glitch they weren't even aware of, it doesn't exactly scream "professional, reliable brand."

-

Warped Business Metrics & Dodgy Forecasting: If you're not accurately segmenting involuntary churn, your overall churn numbers are lying to you. You might think you have a product problem when, in reality, a big chunk of your churn is due to fixable payment SNAFUs. This leads to chasing the wrong solutions.

Revenue Rachel Confessed: "Honestly, before we dug in, I thought our involuntary churn was maybe 5% of our total churn. Turns out, for some segments, it was closer to 15-20%! We were losing nearly a new SDR's salary each month to passive payment failures across our different processors. It was infuriating once we saw the actual numbers."

Unmasking the Culprit: How to Calculate Your Involuntary Churn Rate

So, how do you measure this sneaky beast? The basic formula is simple enough:

Involuntary Churn Rate = (Number of Customers You Lost Because Their Payment Failed in a Period / Total Customers You Had at the Start of That Period) x 100

For example, if you kicked off the month with 1,000 customers and 23 of them disappeared due to payment failures (these are NOT the ones who emailed you saying "I cancel"), your involuntary churn rate for that month is (23 / 1000) * 100 = 2.3%.

The real trick? Knowing for sure which churn is involuntary. This isn't typically spelled out on your main dashboard. It means rolling up your sleeves and:

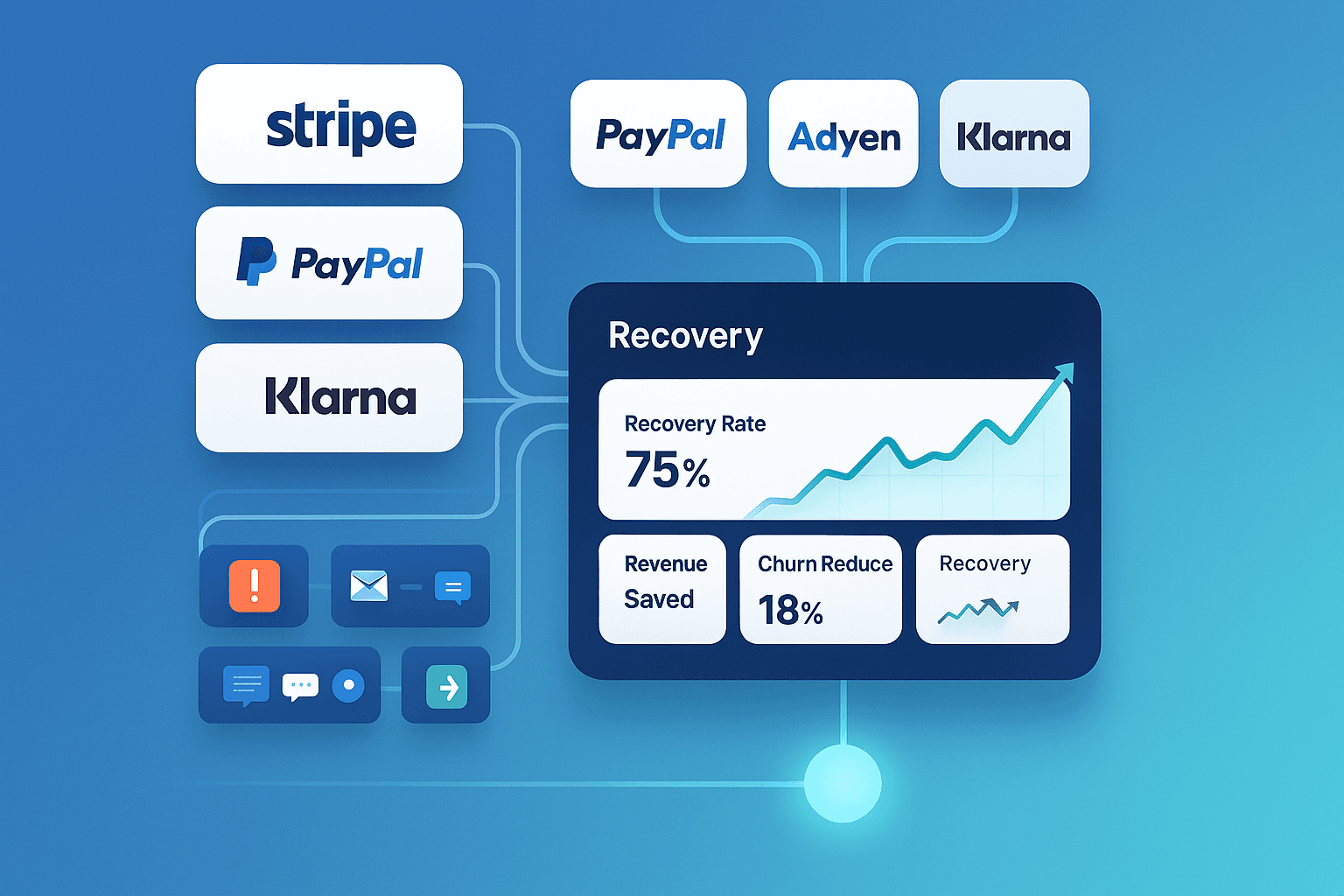

- Becoming a Decline Code Detective: Diving into the actual data from Stripe, PayPal, Adyen, Braintree, GoCardless (the whole gang!) to see why payments are actually failing. Is it 'Insufficient Funds,' 'Expired Card,' or the dreaded 'Do Not Honor'?

- Ruthless Churn Segmentation: You need a clear line between customers who actively bailed and those whose subscriptions just…lapsed due to a payment issue.

- Setting Up Your Tracking Antennae: This can't be a one-off archeological dig. You need a consistent way to monitor these failure points.

This is where things often get messy. Many businesses see an overall churn number but don't have the granular insight to realize that a hefty slice is from solvable payment problems.

From Data Graveyard to Goldmine: Getting Clarity on Churn

Before you can effectively combat involuntary churn with smart dunning tools or retry logic, you need a crystal-clear picture of how big and what kind of problem you're facing. This is where a unified view of all your payment data isn't just nice-to-have; it's mission-critical. While Payoptify isn't a dunning management platform itself, we provide the essential data foundation that empowers you to make those tools work smarter.

By pulling together and making sense of the often chaotic data from all your different payment processors, Payoptify helps you:

- Spot the Real Involuntary Churn: Accurately see which customers are vanishing due to payment hiccups, no matter which processor they were on.

- Nail Down the Financial Bleed: Understand the precise dollar (or Euro, or Pound) amount escaping your business from these passive cancellations.

- Uncover Hidden Patterns & Root Causes: Are certain decline codes rampant? Is one payment processor more problematic? Are specific customer segments or subscription plans more vulnerable?

Armed with this kind of data clarity (the kind that often gets lost when you're juggling multiple processor dashboards), you can then deploy targeted dunning strategies, choose the right recovery tools, and make genuinely informed decisions to stop those preventable revenue leaks. Let's be frank, battling churn is a marathon, not a sprint, but good data is like having a much better pair of running shoes and a map.

What's Next? Time to Turn on the Lights

Involuntary churn thrives in the dark. Its impact on your bottom line, however, becomes glaringly obvious once you start to actively investigate. The crucial first step is to lift the fog and get an honest look at your own payment data.

Ask your team (and yourself):

- Do we genuinely know our true involuntary churn rate, or are we guessing based on overall churn?

- Can we, right now, easily list the top 3 reasons our customers' payments fail, across all our payment systems?

- What's the actual, quantifiable revenue hit we're taking each month from these so-called "passive" churn events?

If the answers are vague, or involve a lot of "well, it's complicated...", then it's probably time to seek clarity.

Don't let this silent killer continue to sabotage your hard-earned growth. Understanding the enemy is always the first step to victory.

Get Expert Insights on Payment Finance

Subscribe to our newsletter for deep dives into payment optimization, cost reduction strategies, and financial data analytics.