Multi-Processor Mayhem? Simplify Dunning with a Unified Recovery Platform

Published on May 28, 2025

• By Burak Isik

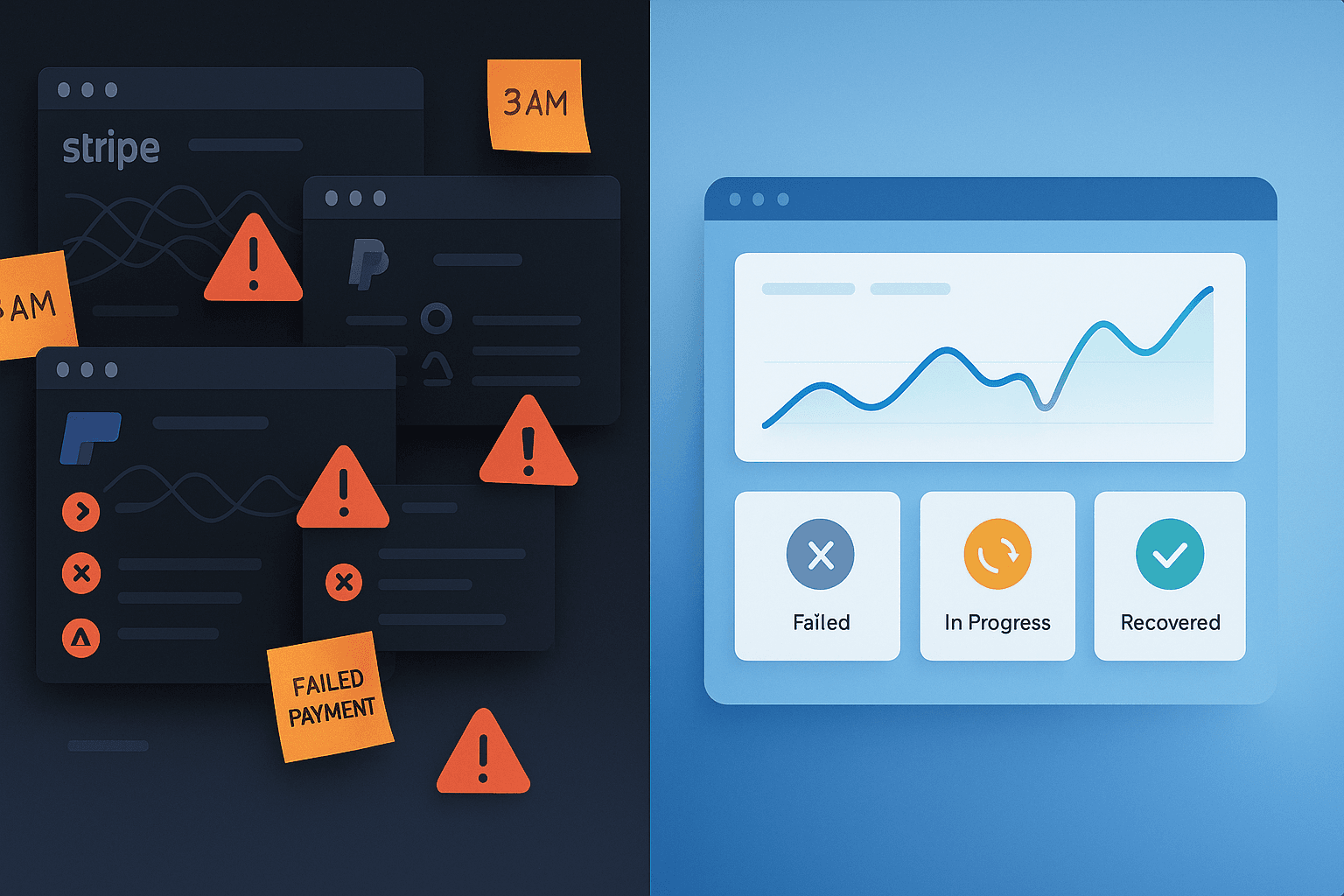

Picture this: It's 3 AM, and your Slack is blowing up. Your biggest enterprise customer's payment just failed on Stripe. But wait – they also have a subscription on PayPal that's about to renew. And their European team uses Adyen. Three different dashboards, three different sets of decline codes, and one very stressed RevOps team.

Sound familiar? If you're nodding along, you're not alone. In the rush to offer customers payment flexibility, many SaaS companies have created a dunning nightmare for themselves. Let's talk about how to fix this mess.

The Real Deal on Multi-Processor Dunning

Look, we've all been there. You add Stripe for credit cards, PayPal for digital wallets, maybe Adyen for international reach. Great for conversions, right? Until the payments start failing.

Here's what actually happens:

- Your team is playing whack-a-mole with failed payments across different platforms

- Customers get confused by inconsistent recovery emails

- You're probably losing more revenue than you think to involuntary churn

- Your analytics are a mess because each processor reports differently

The fix? A unified recovery platform. But before you jump in, you need to understand your payment data. That's where we come in.

The Real Cost of Multi-Processor Dunning

Let's cut through the marketing speak. Here's what actually happens when you're juggling dunning across multiple systems:

The 3 AM Problem

Last week, I talked to a RevOps lead at a SaaS company (let's call them "TechCorp"). They had a $50K enterprise deal fail at 2 AM. The payment was on Stripe, but the customer also had a PayPal subscription. Their team spent hours:

- Checking Stripe's dashboard for the decline code (it was a 3D Secure failure)

- Logging into PayPal to see if the backup payment was still active

- Manually updating their CRM with the fragmented information

- Drafting separate recovery emails for each platform

By the time they had a clear picture, they'd lost valuable recovery time. And this wasn't a one-off – it was happening multiple times a week.

The Customer Experience Mess

Each payment processor has its own quirks. Stripe's dunning emails are clean but basic. PayPal's are... well, they're PayPal's. And Adyen? Good luck customizing those templates.

I've seen customers receive three different recovery emails in one day because their subscriptions were spread across platforms. One was branded, one was generic, and one looked like it came from a different company entirely. Not exactly the experience you want when asking customers to update their payment info.

The Analytics Black Hole

Here's a fun exercise: Try to calculate your true involuntary churn rate across all processors. You'll need to:

- Export Stripe's failed payment report

- Download PayPal's transaction history

- Pull Adyen's decline logs

- Manually match customer IDs across platforms

- Account for different date formats and time zones

- Hope you didn't miss any edge cases

I've seen teams spend entire days on this, only to realize their numbers were off by 20% because they missed some edge cases in the data reconciliation.

The Recovery Rate Problem

Most payment processors offer basic retry logic. Stripe might retry on days 1, 4, and 7. PayPal might try on days 1, 3, and 5. But what if your customer's card is more likely to succeed on day 6? Or what if they're more responsive to SMS than email?

Without a unified view, you're stuck with these basic retry schedules. And that's leaving money on the table.

Real Numbers, Real Impact: In our analysis of 50+ SaaS companies, those using multiple processors without unified dunning lost an average of 12.3% of their customers to involuntary churn. The worst case? A B2B SaaS company lost 18.7% of their enterprise customers because they couldn't effectively manage recovery across their three payment processors.

The Unified Recovery Solution (No BS Version)

Let's be real: A unified recovery platform isn't a magic bullet. But it's the closest thing we've got to solving this mess. Here's what it actually does:

One Dashboard to Rule Them All

Instead of playing platform hopscotch, you get a single view of all failed payments. No more exporting CSVs or manually matching customer IDs. You can see:

- Which customers have failed payments across multiple platforms

- The actual decline codes (not just the generic "payment failed" messages)

- Real-time recovery status across all processors

Smart Recovery, Not Just Retries

The good platforms use actual data to determine when to retry payments. They'll look at:

- Historical success rates for specific decline codes

- Customer time zones and payment patterns

- The value of the subscription

- Previous recovery attempts

Real Multi-Channel Outreach

Email is great, but it's not enough. The best platforms will:

- Send SMS for high-value accounts

- Push in-app notifications

- Use dynamic payment pages with Apple Pay/Google Pay

- Track which channels work best for each customer

Actual Analytics You Can Use

Forget the basic "recovery rate" metric. You need to know:

- Which decline codes are most common across all processors

- Which recovery strategies work best for different customer segments

- The true cost of involuntary churn (including support time and lost expansion revenue)

- ROI on different recovery tactics

How Payoptify Fits In

Look, we're not a dunning platform. But we are the data foundation that makes unified recovery actually work. Here's what we do:

We Connect the Dots

We pull data from all your payment processors and normalize it. That means:

- Consistent decline codes across platforms

- Unified customer IDs

- Standardized transaction data

- Real-time sync with your CRM

We Find the Patterns

Remember that 3 AM problem? We help you spot patterns like:

- Customers who consistently fail on one processor but succeed on another

- Decline codes that are more common with specific card issuers

- Time zones or regions with higher failure rates

- Subscription types that are more prone to payment issues

We Measure What Matters

We give you the real numbers on:

- True involuntary churn across all processors

- Recovery success rates by strategy

- The actual cost of failed payments (including support time)

- ROI on different recovery approaches

The Bottom Line

Managing dunning across multiple processors is a mess. But it doesn't have to be. With the right data foundation and a unified recovery platform, you can:

- Stop the 3 AM panic

- Give customers a consistent recovery experience

- Actually understand your involuntary churn

- Recover more revenue

The choice is yours: Keep playing whack-a-mole with failed payments, or get a system that actually works. We know which one we'd pick.

Get Expert Insights on Payment Finance

Subscribe to our newsletter for deep dives into payment optimization, cost reduction strategies, and financial data analytics.