Are You Overspending on Payments? How Unified Analytics Reveals Your True Costs

Published on April 27, 2025

• By Burak Isik

Introduction: The Hidden OpEx Creep Affecting Your Bottom Line

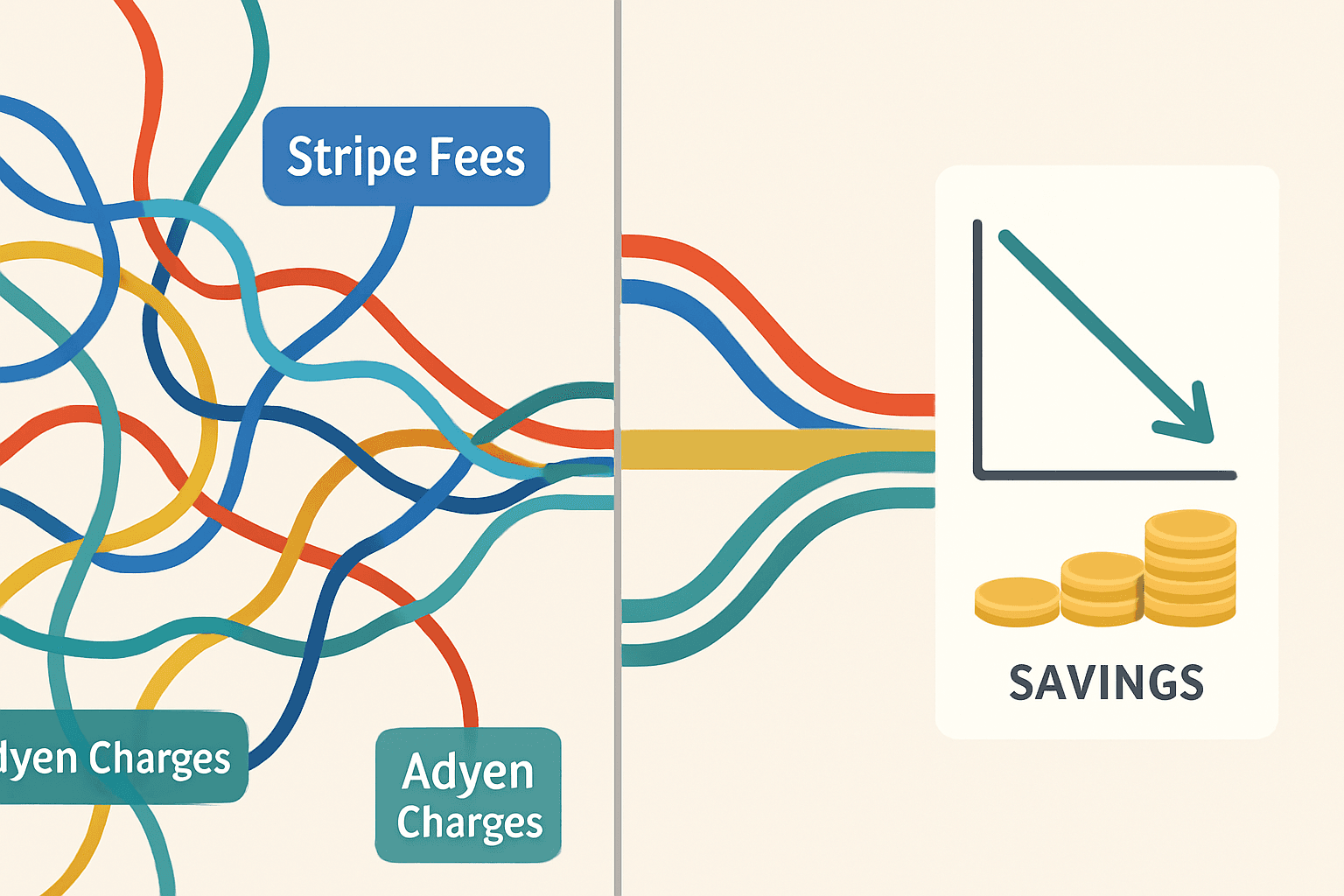

Payments consistently rank as a top operational expense for growing businesses. Yet, the true cost often remains frustratingly opaque. Why? Fragmented data scattered across multiple payment providers, each with unique fee structures and reporting formats, creates a fog that obscures unnecessary costs and drains valuable finance team resources.

You might track the headline processing rates, but what about the myriad of other charges – opaque interchange fees, currency conversion markups, cross-border surcharges, authorization costs, chargeback penalties, and the significant, often underestimated, cost of manual data reconciliation?

This lack of clarity isn't just an operational headache; it directly hinders profitability and skews financial reporting. Without a unified, reliable view, you're likely overspending and basing forecasts on incomplete data. The potential ROI from gaining control is substantial. Unified payment analytics provides the necessary lens to cut through this complexity.

This post explores the common hidden costs lurking within your payment ecosystem and demonstrates how unified analytics platforms, like payoptify, illuminate these expenses, empowering you to optimize spending, improve efficiency, and make truly data-driven financial decisions.

The High Cost of Hidden Complexity & Inefficiency

Your total cost of payments extends far beyond the base rates quoted by processors. Several factors contribute to hidden expenses and operational drag:

Beyond the Processor's Base Rate: Calculating the True Effective Rate

Interchange fees, scheme assessments, and processor markups – often bundled into confusing tiered or opaque interchange-plus models – make calculating a true effective processing rate per provider a significant challenge. This hinders accurate cost allocation and provider negotiation leverage.

Currency Conversion & Cross-Border Fees: Margin Erosion Risk

Selling internationally introduces foreign exchange (FX) markups and cross-border fees. These vary widely between providers and payment methods, adding substantial, often buried, costs that directly erode gross margins on international sales.

The Phantom Menace: Unseen Assessorial Fees

Fees for chargebacks, retrievals, batch processing, PCI compliance, statement generation, and even account maintenance can accumulate quickly. Tracking and allocating these across multiple providers is a manual, error-prone nightmare that inflates your true payment costs.

The Price of Failed Transactions: Paying for Nothing

Declined transactions don't just represent lost revenue; they often incur authorization fees regardless of success. High decline rates, particularly concentrated with specific providers or card types, signify direct cost leakage impacting profitability.

The Invisible Cost: Manual Reconciliation Drain

How many valuable analyst hours does your finance team spend each month manually downloading, normalizing, matching, and reconciling payment data from disparate sources? This significant labor cost represents not only direct expense but also the opportunity cost of preventing focus on strategic financial analysis, forecasting, and identifying growth opportunities.

The Danger: Without unified data, these individual costs multiply, leading to substantial, untracked overspending. This erodes profit margins and undermines the accuracy of financial forecasting and planning.

How Unified Analytics Sheds Light and Drives Efficiency

Unified payment analytics platforms act as a central hub, connecting directly to your various payment sources to automatically collect, normalize, and centralize your data. This creates a single source of truth, enabling transformative cost transparency and efficiency:

Apples-to-Apples Comparisons for Accurate Reporting & Negotiation

By harmonizing disparate data schemas, you can finally compare the true effective rates and total cost of ownership (TCO) for different payment providers, methods, and regional processing. This empowers accurate financial reporting and strengthens your position in provider negotiations.

Identifying Costly Outliers to Prevent Margin Leakage

Centralized dashboards rapidly surface anomalies and outliers, such as spikes in specific fees, unusually high decline rates for certain BINs or regions, or disproportionately expensive transaction types, allowing you to address margin leakage proactively.

Benchmarking Performance for Strategic Optimization

Gain data-driven insights into which providers offer the best cost-effectiveness for your specific business model and transaction patterns (e.g., domestic vs. international, recurring vs. one-time, specific card types).

Streamlining Reconciliation to Reclaim Analyst Time

Automation drastically reduces the manual effort involved in data consolidation and reconciliation. This frees up your finance team from tedious, low-value tasks, enabling them to focus on higher-value activities like variance analysis, financial modeling, and strategic planning.

Connecting Costs to Outcomes for Deeper Financial Insight

Accurately link specific payment fees and processing costs directly to revenue streams, customer segments, product lines, or marketing campaigns. This facilitates more precise contribution margin analysis and profitability reporting.

payoptify in Action: Gaining Cost Clarity & Financial Control

payoptify is engineered to provide finance and RevOps teams with the clarity needed to manage payment costs effectively. Our Unified Data Model automatically ingests and normalizes complex data from providers like Stripe, PayPal, Adyen, Klarna, and more.

Our Insight Dashboards then visualize this unified data, offering clear, actionable views into:

- Comprehensive Fee Analysis: Dissect exactly what you're paying for – interchange, assessments, processor markups, specific assessorial fees – across your entire payment stack.

- True Provider Cost Comparison: See your genuine effective rate and total cost per provider, side-by-side, based on your data.

- Currency Impact Visibility: Understand the real cost implications of FX conversions and cross-border transactions on your profitability.

- Enhanced Financial Modeling: Leverage reliable, unified data feeds to improve the accuracy of your financial forecasts and planning models.

Conclusion: Stop Guessing, Start Optimizing for Profitability

Overspending on payments is frequently a symptom of data fragmentation and operational inefficiency, not a lack of diligence. Relying on disparate, non-standardized provider reports makes it nearly impossible to gain a holistic view, identify savings opportunities, or trust your financial reporting.

Unified payment analytics delivers the clarity required to understand your true costs, benchmark performance accurately, streamline reconciliation, and make informed, strategic decisions that directly reduce expenses and enhance overall profitability.

Don't let hidden fees and manual processes silently drain your bottom line and occupy valuable analyst time. It's time to gain control and unlock the ROI hidden within your payment data.

Get Expert Insights on Payment Finance

Subscribe to our newsletter for deep dives into payment optimization, cost reduction strategies, and financial data analytics.